DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Strengthen the Payment and Next-generation Fintech Business, and Promote Investment and Open Innovation

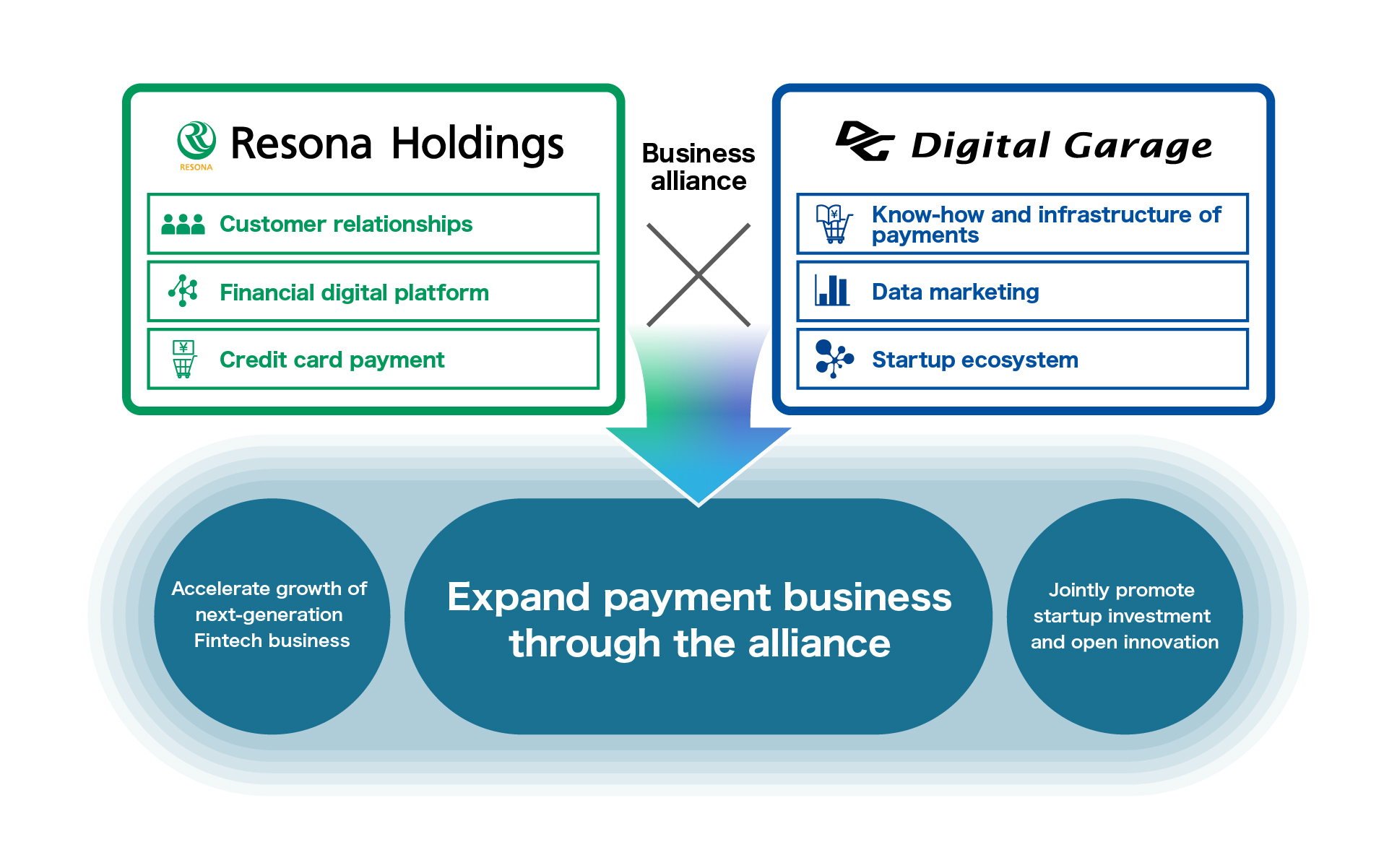

Digital Garage, Inc. (TSE Prime section: 4819; HQ: Tokyo; Representative Director, President Executive Officer and Group CEO: Kaoru Hayashi; DG) and Resona Holdings, Inc. (TSE Prime section: 8308; HQ: Tokyo; Group CEO, Director, President and Representative Executive Officer: Masahiro Minami; Resona HD) agreed to reinforce the capital and business alliance formed in November 2022. In addition to strengthening their partnership in the payment business and next-generation Fintech business, the two companies will also begin collaboration in the startup investment and open innovation businesses.

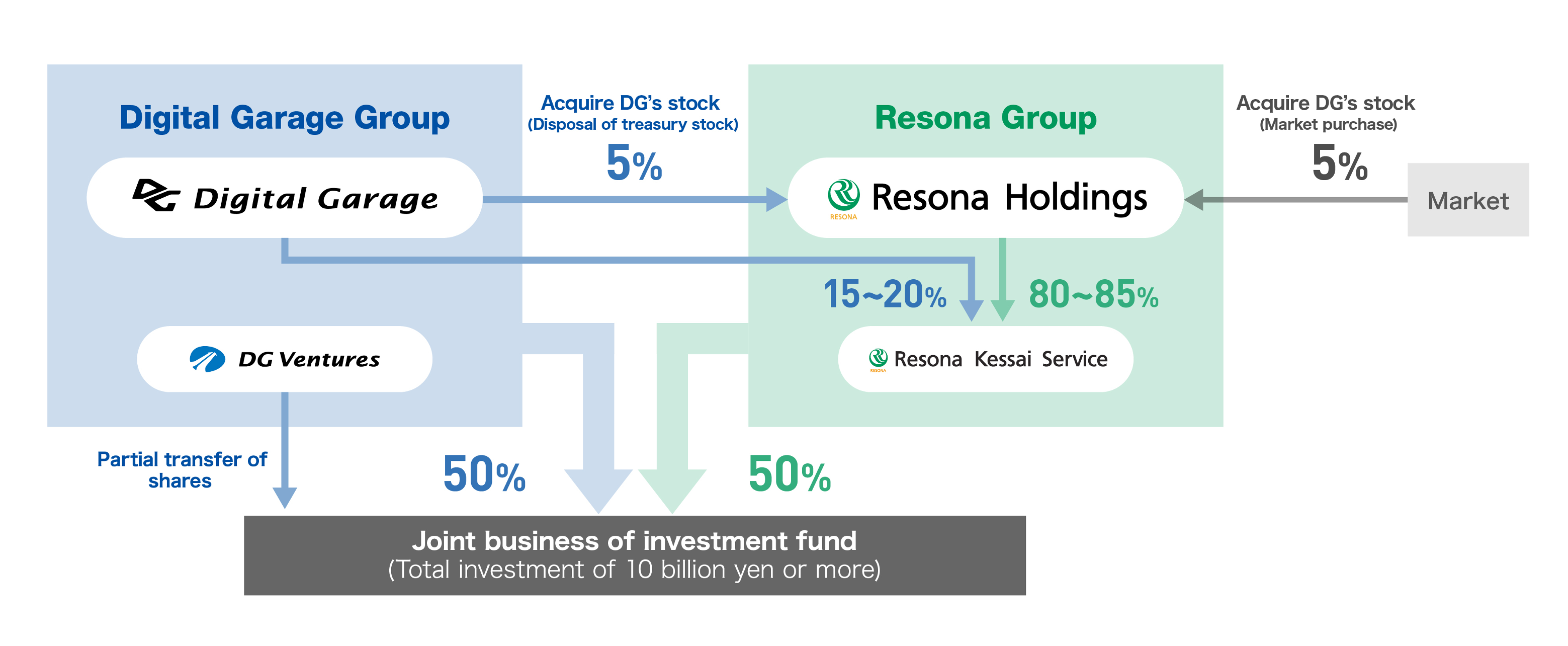

In accordance with the reinforcement of the alliance, Resona HD plans to acquire an additional 10% of DG’s shares through a third-party allocation of treasury stock and market purchases of DG stock.

DG and Resona HD formed a capital and business alliance in November 2022 and consistently expanded their collaboration centered on payment business. Combining their business resources though this alliance, DG and Resona HD plan to contribute to building a convenient, safe, and secure cashless society by strengthening and expanding respective market share of their payment business and accelerating next-generation Fintech businesses, which both companies have set as key businesses focus within their Medium-term Plan.

(For more details, please refer to “Appendix: Summary of Transactions Involving the Reinforcement of the Alliance”)

| 1.Payment Business: Providing payment services to Resona Group’s 500,000 corporate clients by building a joint sales force centered on Resona Kessai Service. |

|---|

|

| 2.Next-generation Fintech Business: Jointly develop next-generation Fintech services to meet diverse customer needs and offer them to customers of both companies. |

|

| 3.Startup Investment and Open Innovation Business: Accelerate growth through joint operation of investment funds and utilize startups’ advanced technologies and business models. |

|

DG will use the proceed from the disposal of treasury stock for strategic M&A initiatives including partial acquisition of RKS, new business development initiatives on the next-generation Fintech business, and system enhancement initiatives to further enrich its payment system infrastructure. In addition, DG will develop a new business line, “Processing Platform Business,” that will focus on providing DG’s payment system infrastructure to external payment service providers. DG will support the expansion of the Japanese Fintech market by providing a payment system infrastructure that supports various companies to enter the payment business easily and efficiently.

This alliance will further enhance diversification of DG’s finance and DX service offerings, including finance, e-commerce and marketing business leveraging its purchasing data, to address various customer demand. DG will accelerate the diversification of its revenue models and expansion of profit margins in accordance with its group strategy, “DG FinTech Shift,” and aspire to achieve the Medium-term Plan announced in May 2023.

Kaoru Hayashi, Representative Director, President Executive Officer and Group CEO of Digital Garage, Inc.

Digital Garage is working with various strategic partners on the “DG FinTech Shift,” a group strategy that integrates payments, data, and technology. With the increasing expectations toward financial institutions to solve local and social issues, including easing the Banking Act, this partnership will provide superb growth opportunities for both companies. By strengthen the partnership with Resona Group, which aims to become “Retail No. 1” bank and poses one of the largest corporate clients, branches, organization, and financial expertise in Japan, we will further accelerate of group strategy, “DG FinTech Shift” and support the creation of next-generation business models in Japan.

Masahiro Minami, Group CEO, Director, President and Representative Executive Officer of Resona Holdings, Inc.

Resona Group is working to co-create and expand value with strategic partners with the aim of becoming the “Retail No. 1” Solutions Group. We are confident that by combining the strengths of both companies through this alliance enhancement, we will be able to solve diversified and high-level social issues and grow the payment businesses of both companies remarkably. Through our partnership with Digital Garage, which has payment solutions for various needs, a global startup ecosystem, and a First Penguin Spirit that bravely takes on unknown business areas, we will provide retail customers with a new payment experience and contribute more than ever to customers and local communities.

1. Disposal of Treasury Stock through a Third-Party Allocation

Digital Garage, Inc. (the Company) resolved at a meeting of the Board of Directors held on December 22, 2023 to dispose treasury stock through a third-party allocation, as described below, and entered into a total stock subscription agreement with Resona HD, the planned recipient of disposal.

| (1)Payment date: | January 9 (Tuesday), 2024 | |

|---|---|---|

| (2)Number of shares for disposal: | Common stock, 2,500,000 shares | |

| (3)Disposal price: | 3,660 yen per share | |

| (4)Funds to be raised: | 9,150,000,000 yen | |

| (5)Disposal method: | Third-party allocation | |

| (6)Planned recipient of disposal: | Resona Holdings, Inc. | |

| (7)Others: | The Disposal of Stock shall be subject to the effectiveness of the securities registration statement under the Financial Instruments and Exchange Act. |

After acquisition of the Company’s common stock through the Disposal of Stock, Resona HD plans to additionally acquire 2,261,000 of the Company’s common stock (4.77% of voting rights and 4.75% of total number of issued shares after the Disposal of Stock) through market purchases. (However, depending on the market stock price, Resona HD may not purchase up to the maximum limit.) Upon completion of the additional acquisition, Resona HD will become a major shareholder of the Company.

2. Related transactions

The Company and Resona HD have reached a basic agreement to conduct each of the following transactions related to the reinforcement of this alliance after the additional acquisition of the Company’s stock through the disposal of treasury stock through a third-party allocation.

(1) Partial acquisition of shares of Resona Kessai Service Co., Ltd. by the Company

The Company has reached a basic agreement with Resona HD to acquire a partial share of Resona Kessai Service, a subsidiary of Resona HD, strengthening the joint sales structure with Resona Group. In collaboration with Resona Group, the Company will provide its latest payment solutions to Resona Group’s clients, and Resona Group will provide its financial solutions to the Company Group’s clients. The Company’s shares in Resona Kessai Service will be in the range of 15% to 20%. The terms and conditions of the share acquisition, including the number of shares to be transferred and the acquisition price, will be agreed upon through separate discussions between Resona HD and the Company.

【About Resona Kessai Service】

| (1)Name: | Resona Kessai Service Co., Ltd. | |

|---|---|---|

| (2)Date founded: | October 25, 1978 | |

| (3)Name of representative: | Masanori Hirokawa | |

| (4)Head office address: | 1-5-25 Kiba, Koto-ku, Tokyo | |

| (5)Business: | A subsidiary of Resona HD, which operates a payment collection agency, factoring, and payment business, with assets of over 300 billion yen and more than 2,000 partners. The company offers a variety of financial solutions, including factoring and guarantees, in addition to payment collection services that handle 50 million cases annually. |

(2) Transactions related to global investment incubation business

The Company will jointly establish an investment fund with Resona Group with a total investment of 10 billion yen or more. The Company has agreed to allow this joint investment fund to acquire a portion of the operating investment securities held by the Company’s subsidiary DG Ventures, Inc. and jointly manage this fund.

The Company and Resona HD plan to hold an equal share of 50% in the joint investment fund directly or indirectly. The structure of this joint investment fund and its composition and operation details, including the content and consideration for the operational investment securities to be acquired, will be agreed upon through separate discussions between the Company and Resona HD.