DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Quick Financing Based on an AI Sales Prediction Model

– Digital Garage, Inc. (DG) will begin offering “Quick Money*1.” This financing service for small- and medium-sized business (SMB) operators can be used to pay sudden expenditures and expenses during off-periods and before busy seasons.

– Compared to major corporations that have multiple means of financing, it has been difficult for SMBs to handle unexpected fund needs. This takes great labor and time, including complex procedures to pass loan screenings for financing from financial institutions and other organizations.

Online lending for SMBs, as well as individual business operators, is drawing attention as a speedy financing method that simplifies these complicated procedures and lengthy loan screenings. The size of this market and its number of users are growing, and many different services are offered outside of Japan.

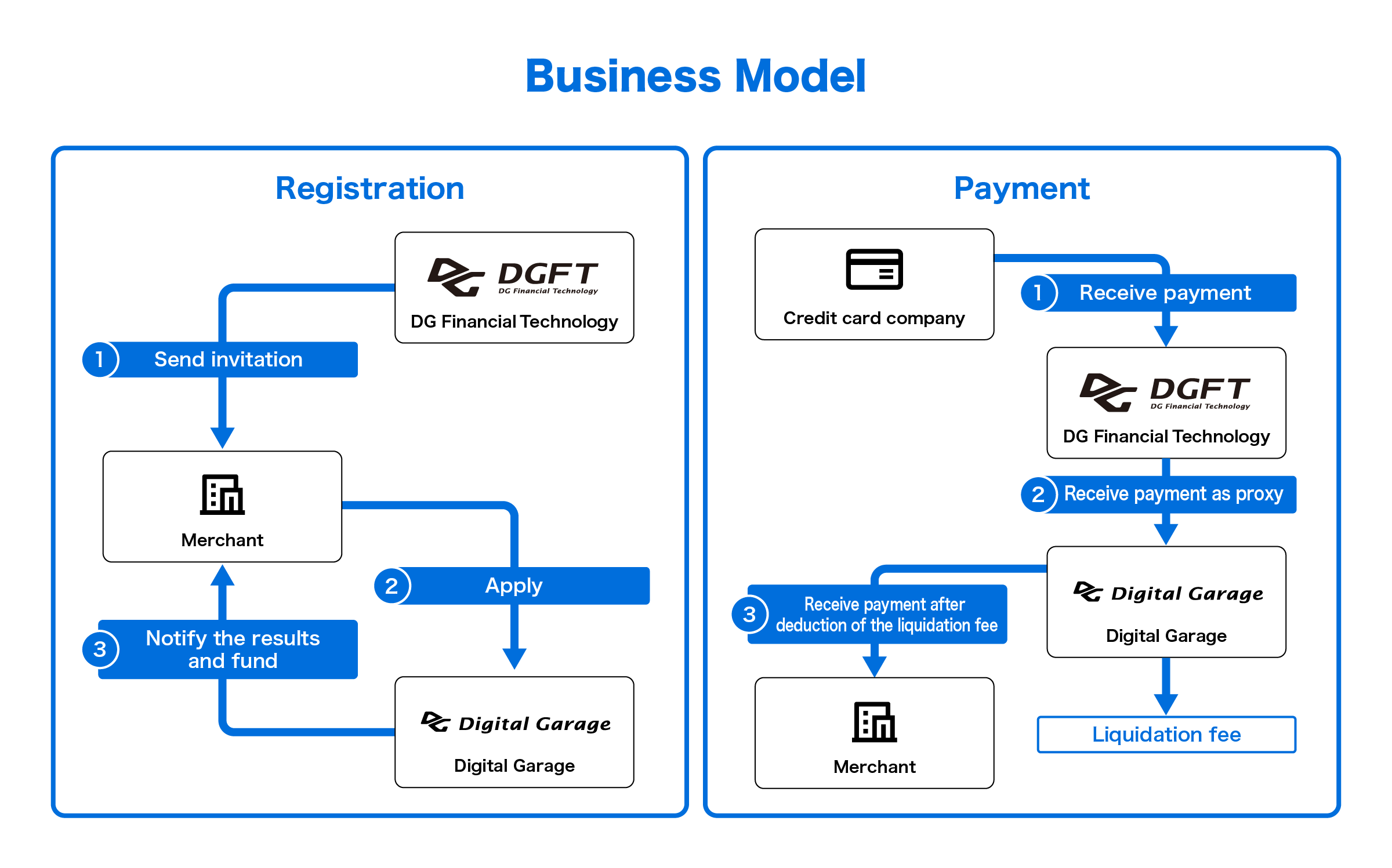

DG decided to develop and offer “Quick Money”—an easy online financing service—for SMBs that want to improve their cash flows and operational efficiency. “Quick Money” is available on an invitation-only basis to merchants using payment services from DG Financial Technology, Inc., a payment service provider and a subsidiary of DG. It uses an AI sales prediction model*2 to estimate the merchant’s future sales proceeds (future claims), which DG purchases a portion of. Unlike regular financial services, “Quick Money” users do not have to submit financial statements or other additional screening documents in principle. They can receive funds easily and quickly in as little as five business days. The merchant pays the sold claim according to their business circumstances because a set ratio (transfer ratio) is calculated and deducted from the amount of their monthly sales paid by credit card and others.

https://quickmoney.garage.co.jp/

Going forward, DG will expand the “Quick Money” functions and collaborate with service business operators that have small- to medium-sized merchants, including E-Commerce platforms. It will also utilize AI technologies and a wide range of data to develop new financial services after “Quick Money.”

Amidst significant changes in the Japanese social and industrial structures, the DG Group is doing business in the DX and Fintech fields based on the “DG FinTech Shift,” a Group strategy that integrates payment and data to promote DX in Japan. Its first B2B Fintech service is “DGFT Invoice Card Payment*3,” a service that effectively moves out payment due dates by switching invoice payments from bank transfers to card payments. By offering this service along with “Quick Money,” DG will help SMBs improve cash flows and business efficiency to support their growth.

*1: “Quick Money” is an invitation-only service offered to merchants of the VeriTrans Receiving Agent Service (a multi payment service) according to their usage histories.

*2: Based on an original algorithm developed by DG Lab, an open innovation research organization operated by Digital Garage, Inc.; Kakaku.com, Inc.; and KDDI CORPORATION for the purpose of creating new businesses.

*3: Reference release: “Digital Garage and JCB Launches B2B Payment Service 〜DGFT Invoice Card Payment Helps Small to Medium-sized Businesses Manage their Cash Flow and Improve their Operational Efficiency〜” (November 10, 2022)