DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Supporting a Secure Operation Structure in Which Operators Handle No Credit Card Information for Telephone Orders

– DG Financial Technology, Inc., a payment service provider and a subsidiary of Digital Garage, Inc. (DG), is providing its interactive voice response (IVR) payment solution for telephone ordering to IRIS Plaza, the official IRIS OHYAMA online shopping website operated by IRIS Plaza Co., Ltd.

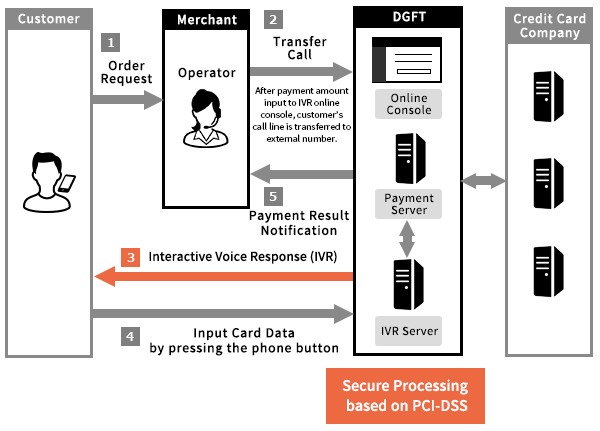

With the IVR payment solution, telephone orders are taken at the call center via an IVR system, and the consumer performs the credit card payment on their own (patented, patent no. 5457498).

After implementing the IVR payment solution, the operator does not have to listen to the customer’s credit card information to perform order processing. This reduces card information input errors and leakage and the risk of loss, making it possible to complete these tasks in an environment with high-level security. The customer is transferred to the IVR system when making a payment. In some cases, this cuts the average time spent on the telephone by 30% or more (according to research by DGFT), which on average takes two to three minutes. This solution is also expected to help reduce operators’ time spent doing these tasks. Companies can easily and cheaply implement this service without any system development or integration as long as they have a telephone that can transfer to an external line and a computer connected to the Internet. It can be used starting from just one operator.

The COVID-19 pandemic brought a heightened awareness of contactless transactions and increased in-home consumption, resulting in a larger number of telephone orders. Accordingly, IRIS Plaza introduced this IVR payment solution as a service to create a more secure operating environment. IRIS Plaza highly appraised this solution’s simple, easy-to-understand management screen that helps reduce the burden on its operators.

According to the Installment Sales Act, business operators that handle credit cards must appropriately manage credit card information and take security measures to prevent fraudulent usage. In addition, more advanced security measures are also required with the progress of cashless payments.

Since its establishment, DGFT has built the advanced security environment and management systems required of financial institutions and has provided safe and secure payment solutions for both businesses and consumers. DGFT will continue to provide solutions required by card merchants to prevent credit card information leakage and fraudulent use, including IVR payment solutions. This way, DGFT will minimize the burden on business operators taking security measures and help build secure payment environments.

【About DG Financial Technology, Inc.】

https://www.dgft.jp/

A payment provider offers comprehensive payment services to e-commerce and other online businesses, stores, and face-to-face interactions. Payments can be made at 700,000 locations (non-face-to-face and face-to-face), with an annual transaction volume exceeding 4.4 trillion yen (as of March 31, 2022). In April 2021, the company name was changed from VeriTrans Corporation to DG Financial Technology. As a core company of the DG Group’s “DG FinTech Shift,” DGFT supports businesses in their efforts to go cashless and promote DX from the payment and financial domains. Furthermore, we will continue to contribute to developing a sustainable society as a helpful infrastructure business by providing highly convenient functions and services to merchants and end-user consumers and offering a safe, secure, and comfortable payment experience.