DG Mail

DG Mail is an e-mail magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

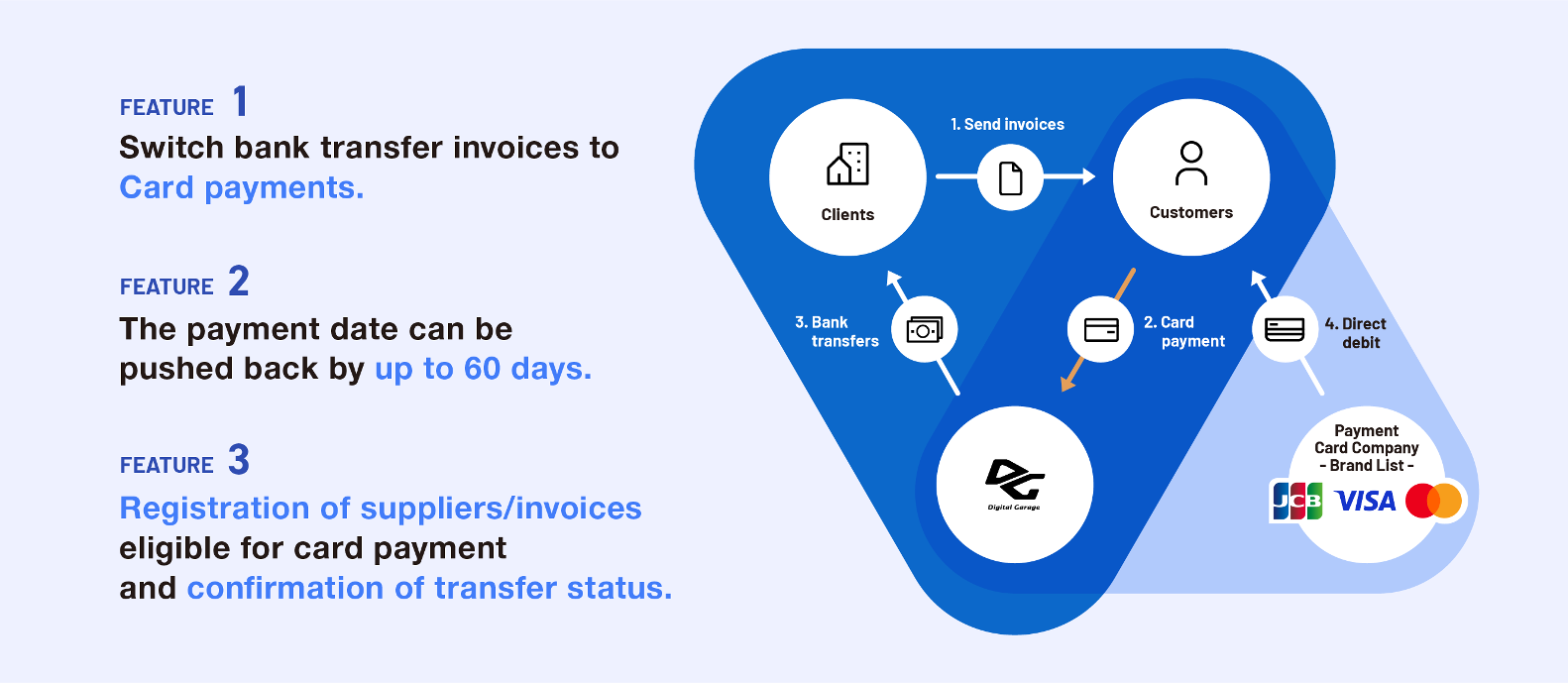

First Service of the Kind in Japan to Enable the Use of Three Major Card Brands. Helps Small and Medium-sized Businesses Manage Cash Flows and Improve Operational Efficiency

– B2B payment service “DGFT Invoice Card Payment” now accepts Visa and Mastercard® brands in addition to JCB.

– DG will continue creating new Fintech services and update customer experiences utilizing transactional data and learnings from this service.

Digital Garage, Inc. (TSE Prime section: 4819; HQ: Tokyo; Representative Director, President Executive Officer and Group CEO: Kaoru Hayashi; DG) is pleased to announced that its B2B payment service, “DGFT Invoice Card Payment,” now accepts Visa and Mastercard® brands*1 in addition to JCB. This service practically moves out payment due dates by switching invoice payments from bank transfers to card payments. This service was launched in November this year as the first B2B Fintech business as a result of the alliance between DG and JCB Co., Ltd.*2

https://lp.dginvoice.jp/

・ Payments for invoices by bank transfer can be switched to card payments with JCB/Visa/Mastercard® branding, excluding prepaid cards issued by JCB brand. This service is available even if the business partner does not allow card payments.

・Users can practically move out payment due dates up to 60 days when using a credit card.*3 It supports working capital management issues, such as regular cash shortages due to seasonal factors and unexpected financial needs of small and medium-sized businesses.

・All applications for use (registration of suppliers/invoices, etc.) can be made on the “Customer Service Page.” Users can also check the status of their application, past usage, and transfer details in a list.

Many startups in the Fintech domain have emerged overseas for small and medium-sized businesses, and B2B payment services are becoming more widespread. In Japan, the digitization of B2B business transactions is expected to advance further in the future due to the amendments to the Electronic Book Preservation Act in 2022 and the introduction of the invoice system coming in October 2023, creating the ground for new payment services that meet the individual needs of users to spread.

DG has the group strategy, “DG FinTech Shift”, which integrates payment and data, to promote DX in Japan to drive the social and industrial structure.

DG aims to continue contributing to the cash management and operational efficiency of small and medium-sized businesses, as well as attracting more customers and increasing sales. Toward this end, expansion of the “DGFT Invoice Card Payment” functionality, linkage with external services, support services for merchants in digital marketing, and smooth and convenient customer experience are all part of DG’s efforts to provide a better service to its customers. In addition, DG will continuously develop new services such as next-generation payment and Fintech marketing services.

*1: In addition to credit cards, debit cards and prepaid cards compatible with each brand issued in Japan can be used. (Excluding prepaid cards issued under the JCB brand)First B2B payment service in Japan to support the three major card brands of JCB, Visa, and Mastercard®(As of December 9, 2022, according to Digital Garage, Inc.)This service is compliant with “Business Payment Solution Provider (BPSP)” of VISA, “Business Payment Aggregator Program (BPAP)” for B2B payment services of Mastercard®, and “BtoB Payment Solution Transactions” of JCB.

*2: Related Press Release “Digital Garage and JCB Launches B2B Payment Service ~“DGFT Invoice Card Payment” Helps Small to Medium-sized Businesses Manage their Cash Flow and Improve their Operational Efficiency~”(November 10, 2022)

*3: The number of days in which the actual payment due date can be deferred depends on the card used. Also, debit cards and prepaid cards are not eligible for deferral.