2021.02.26

Proof of Concept Utilizing Blockchain Technology to Issue “Digital Corporate Bonds”

Digital Garage, Inc. (TSE first section: 4819; HQ: Tokyo; Representative Director, President Executive Officer and Group CEO: Kaoru Hayashi; DG); Daiwa Securities Group Inc. (TSE first section: 8601; HQ: Tokyo; President & CEO: Seiji Nakata; Daiwa Securities Group) start conducting a proof of concept (PoC) on utilizing blockchain technology to issue securities. As described below, Daiwa Securities Co. Ltd. (President and CEO: Seiji Nakata; Daiwa Securities) and Daiwa Food & Agriculture Co. Ltd. (President and CEO: Kenji Ochi; Daiwa F&A) each issue “Daiwa Securities Digital Corporate Bonds” and “Daiwa F&A Digital Corporate Bonds”*1 in the PoC (“this PoC”).

This PoC was conducted in collaboration with Crypto Garage, Inc. (HQ: Tokyo; Representative Director: Masahito Okuma; Crypto Garage), a DG subsidiary developing blockchain financial services. Crypto Garage completed the development of an environment for issuing digital corporate bonds in a short period of time.

Crypto Garage has technologies such as Delivery versus Payment settlements (DvP) payments and asset issuance. With technologies Crypto Garage holds, information regarding “Daiwa Securities Digital Corporate Bonds” and “Daiwa F&A Digital Corporate Bonds” held by investors is recorded on “Liquid Network”*2, a blockchain platform. By utilizing Blockstream AMP, a platform for the tokenization of securities built on the Liquid sidechain of Bitcoin, a corporate bond issuer can directly verify each corporate bond investor’s identity. Investors can also directly verify the quantity of the securities they hold, which could cut administration costs in the future.

Based on the knowledge gained from this PoC, Daiwa Securities Group will diversify the fundraising methods available to issuers, improve investment opportunities for investors, and provide new value to society as a “financial and capital market pioneer.”

Through Crypto Garage, DG will continue actively working on digital asset projects and contributing to the technological development of Japanese financial and capital markets. DG’s DG Lab will also carry out R&D on Security Token Offering (STO) market expansion, as well as business development in blockchain-based digital assets.

The regulations on timely disclosure established by Financial Instruments Exchanges do not apply to this matter.

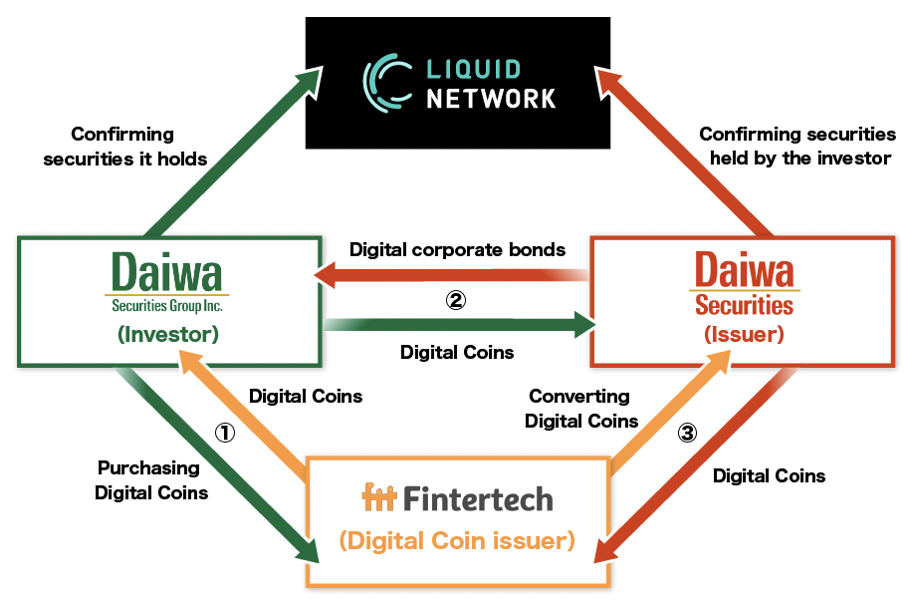

1. About “Daiwa Securities Digital Corporate Bonds” and “Digital Coins”

“Daiwa Securities Digital Corporate Bonds” are issued by Daiwa Securities in the self-offering format to Daiwa Securities Group. As the investor, Daiwa Securities Group pays with “Digital Coins” issued on “Liquid Network” as a prepaid payment method by Fintertech Co. Ltd. (President: Makoto Takeda). The plan is for “Digital Coins” to also be used for digital corporate bond interest payments and retirement by purchase.

Issuance uses the same structure as DvP payment. When the “Digital Coin” payment is made, the digital corporate bond holder record on “Liquid Network” is updated.

This is Japan’s first securities issuance and retirement by purchase using a prepaid payment method recorded on a blockchain.

With the ability to utilize blockchain technology for rights transfer and securities issuance, transfer, interest payment, redemption, etc. via digital currency, the Daiwa Securities Group will issue and administer securities with a high degree of transparency, accuracy, and efficiency in the future. We believe this will lead to the securitization of assets that were previously not securitized, as well as greater efficiency in the securities distribution market.

In issuing “Daiwa Securities Digital Corporate Bonds,” we will verify new securities payment methods using “Digital Coins.”

<“Daiwa Securities Digital Corporate Bonds” and “Digital Coin” scheme *At time of issuance>

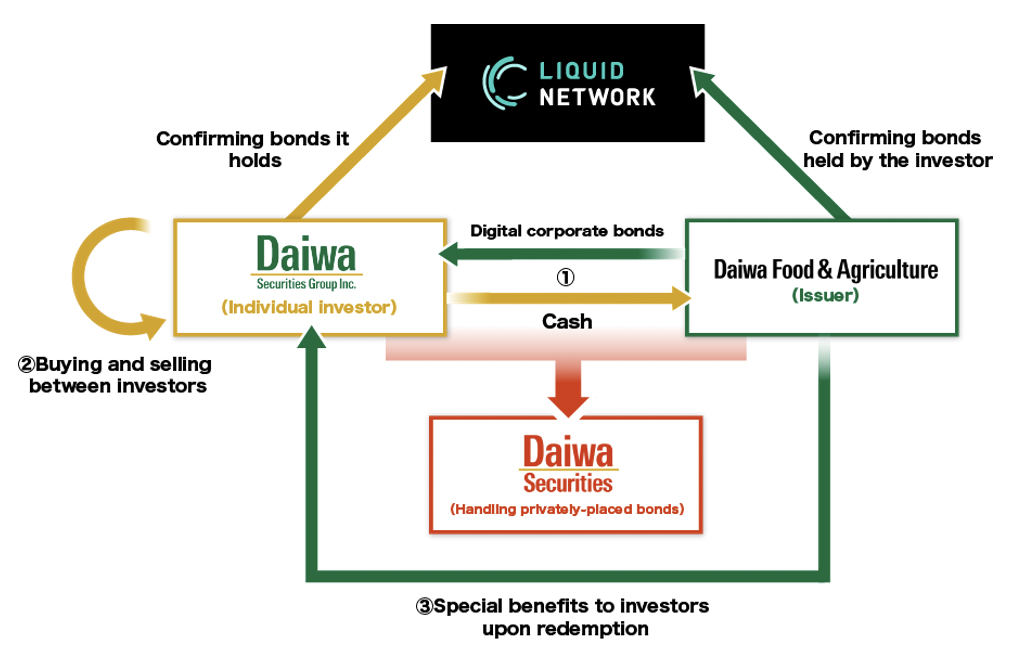

2. About “Daiwa F&A Digital Corporate Bonds”

“Daiwa F&A Digital Corporate Bonds” were issued by Daiwa F&A to Daiwa Securities Group officers and employees, with Daiwa Securities handling privately-placed bonds. These corporate bonds can be bought and sold among investors. Daiwa F&A also plans to give agricultural products produced by Mirai no Hatake kara Co.Ltd. (President: Kazunori Hisaeda)as a special benefit to the investor at the time of redemption.

The Daiwa Securities Group will manage its investor name register on the blockchain in the future. In this way, the issuing company will be able to manage investor information directly. It can also grant access rights to facilities and events, as well as special benefits and points, depending on holding periods and quantities.

In issuing “Daiwa F&A Digital Corporate Bonds,” we will demonstrate the efficiency of a new type of communication through securities.

<“Daiwa F&A Digital Corporate Bonds” scheme>

*1: The “Rights to Be Indicated on Securities With Electronic Record Transfer, Etc.” prescribed in Article 1, Paragraph 4, No. 17 of the Cabinet Office Order on Financial Instruments Business, etc. does not apply to “Daiwa Securities Digital Corporate Bonds” and “Daiwa F&A Digital Corporate Bonds.”

*2: The “Liquid Network” is a sidechain based on Bitcoin technology that allows for the fast, confidential, and secure transfer of Bitcoin and various digital assets between companies. Since its launch in October 2018, the “Liquid Network” is managed and operated by a federation of 59 members—, including cryptocurrency exchanges, market makers, brokers, financial operators, and other crypto -asset-related companies around the world—ensuring that it has no single point of failure.

<Outline of “Daiwa Securities Digital Corporate Bonds”>

| 1.Issuing company | Daiwa Securities Co. Ltd. |

|---|---|

| 2.Issue price | 10 Million Yen (Paid by Digital Coins in principal) |

| 3.Term | March 26, 2021 |

| 4.Interest rate | 0.03% per year (Paid by Digital Coins in principal) |

| 5.Offer format | Self-offering |

| 6.Payment date/Issue date | February 25, 2021 |

<Outline of “Daiwa F&A Digital Corporate Bonds”>

| 1.Issuing company | Daiwa Food & Agriculture Co. Ltd. |

|---|---|

| 2.Issue price | 1 Million Yen |

| 3.Term | March 26, 2021 |

| 4.Interest rate | 0.10% per year |

| 5.Offer format | Private placement by Daiwa Securities |

| 6.Payment date/Issue date | February 25, 2021 |