DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

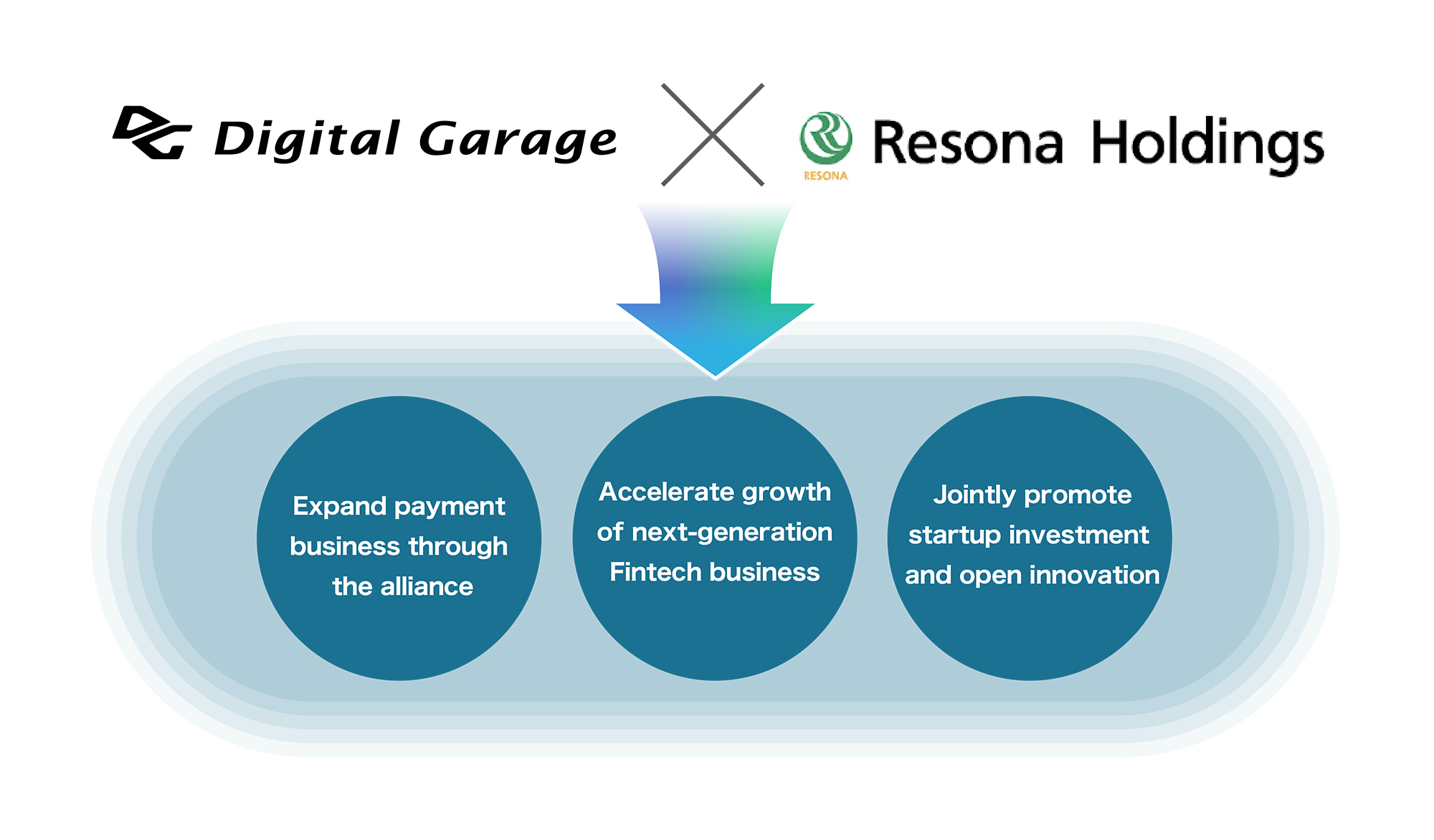

In 2022, Digital Garage and Resona Holdings formed a capital and business alliance aimed at strengthening their payment business, expanding market share, and advancing next-generation fintech business. By 2023, the partnership deepened further, extending into collaborative efforts in open innovation through startup investments. This four-part series explores the details of their collaboration and their shared vision for the future.

The first installment examines the background of their business alliance, providing an overview of the specific initiatives and their goals.

In November 2022, Digital Garage and Resona Holdings officially entered into a capital and business alliance. While the two companies had prior business dealings, the significant potential synergies drove them to formalize their partnership.

For Digital Garage, which advocates the group strategy “DG FinTech Shift,” integrating payments, data, and technology, the digital transformation (DX) of Japan’s small and medium-sized businesses (SMBs)—which constitute over 90% of domestic companies—was a major focus. The company aimed to leverage its expertise to support SMBs in their DX journey, thereby revitalizing the Japanese economy and creating next-generation business models. Resona Holdings, with its strong customer base among SMBs and its commitment to being “Retail No. 1,” emerged as an ideal partner for this mission.

Conversely, Resona Holdings recognized the strategic importance of Digital Garage’s business foundation and customer network. The bank sought to transform its own services by leveraging Digital Garage’s payment infrastructure and technological expertise. The partnership promised to strengthen and expand their payment business—a key growth area—while enabling the realization of “next-generation retail services” that transcend traditional banking norms.

By December 2023, the two companies agreed to deepen their alliance, aiming to integrate resources more effectively. They identified 2 key objectives as part of their respective medium-term business strategies: “strengthening and expanding payment business” and “accelerating the growth of next-generation fintech services, including DX-driven financial offerings.”

In announcing the strengthened alliance, Hayashi Kaoru, Representative Director, President Executive Officer and Group CEO of Digital Garage, stated: “With the increasing expectations toward financial institutions to solve local and social issues, including easing the Banking Act, this partnership will provide superb growth opportunities for both companies. By strengthening the partnership with Resona Group, which aims to become “Retail No. 1” bank and possesses one of the largest corporate clients, branches, organization, and financial expertise in Japan, we will further accelerate the group strategy, “DG FinTech Shift” and support the creation of next-generation business models in Japan.”

Masahiro Minami, Group CEO, Director, President and Representative Executive Officer of Resona Holdings, commented: “We are confident that by combining the strengths of both companies through this alliance enhancement, we will be able to solve diversified and high-level social issues and grow the payment businesses of both companies remarkably. Through our partnership with Digital Garage, which has payment solutions for various needs, a global startup ecosystem, and a First Penguin Spirit that bravely takes on unknown business areas, we will provide retail customers with a new payment experience and contribute more than ever to customers and local communities.”

The partnership between Digital Garage and Resona Holdings centers on 3 key areas:

| 1.Payment Business: Providing payment services to Resona Group’s 500,000 corporate clients by building a joint sales force centered on Resona Kessai Service. |

|---|

|

| 2.Next-generation Fintech Business: Jointly develop next-generation Fintech services to meet diverse customer needs and offer them to customers of both companies. |

|

| 3.Startup Investments and Open Innovation Business: Accelerate growth through joint operation of investment funds and utilize startups’ advanced technologies and business models. |

|

Approximately a year since the announcement of the strengthened partnership, initiatives across various areas are steadily progressing, and results are already beginning to emerge.

In the Payments Business, Digital Garage completed its equity acquisition in RKS in April 2024, resulting in more robust service integration and talent exchanges between the two groups. These efforts are fueling the expansion of their payment-related businesses.

In the Next-generation Fintech Business, the companies launched multiple new services within a year of initiating joint development efforts: “CurePort,” a service utilizing an AI model to assess credit risk for restaurants, and “Online Invoice Card Payment,” a B2B payment service. These services represent innovative financial solutions tailored to specific industries, with further concepts already in the pipeline. Numerous concepts continue to emerge, and moving forward, the creation of new businesses leveraging the assets of both parties and the provision of services to their respective customers will further accelerate.

In the Startup Investments and Open Innovation Business, the joint CVC fund—“DG Resona Ventures Fund I Investment Limited Partnership”—was established in April 2024. The fund prioritizes strategic returns alongside financial gains, fostering new connections with a variety of startups.

Looking ahead, the two groups will continue to deepen their collaboration, leveraging the 3 core values of their partnership to expand existing services and create entirely new businesses.

In the Payments Business, the partnership aims to extend value to a broader range of clients, from large enterprises to regional SMBs, driving nationwide DX adoption. Through the Next-generation Fintech Business and Startup investments and Open Innovation Business, the companies will combine their assets to develop services that meet emerging societal needs.

Ultimately, both groups share a common goal: revitalizing Japan’s economy. By promoting DX through existing businesses and fostering innovation through new initiatives, they hope to accelerate the circulation of capital in society, thereby enhancing their social value.

In upcoming installments, we’ll delve into the specifics of the “Payment Business,” “Next-Generation Fintech Business,” and “Open Innovation and Startup Investments Business.” Interviews with key project leaders will shed light on their objectives, ongoing efforts, achievements, and future plans.