CEO Comments

Kaoru Hayashi

Representative Director,

President Executive Officer and Group CEO,

Digital Garage, Inc.

Volume 73, 2021.05.13

CEO Comment Vol.73 “FYE March 2021 Financial Report Summary”

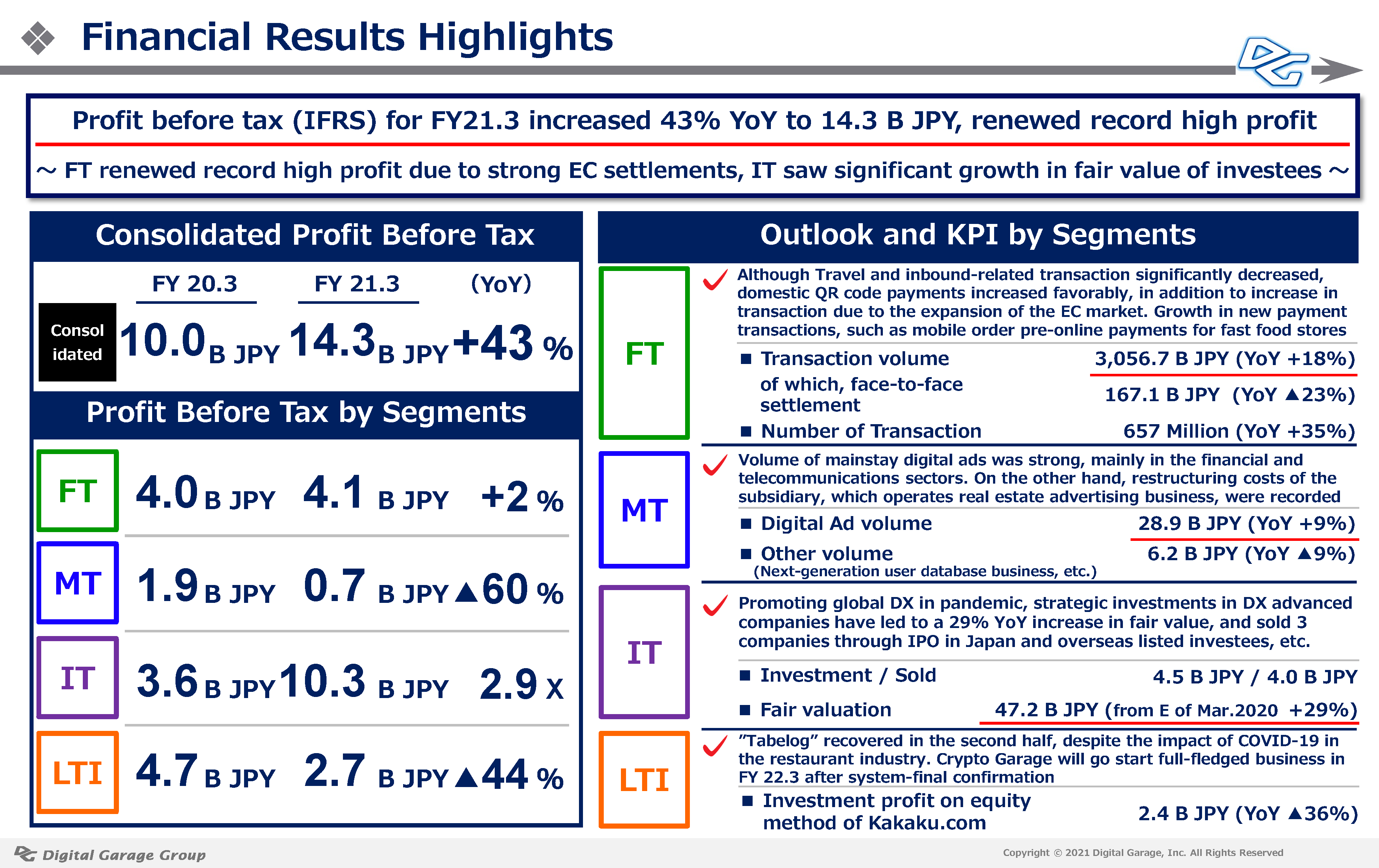

~Profit before tax (IFRS) for FY21.3 increased 43% YoY to 14.3 B JPY, renewed record high profit~

With the approval of the Board of Directors today, we have announced FY21.3 financial results (IFRS).

Ⅰ. Summary of FY21.3 Financial Results

Despite being affected by the spread of the COVID-19 infection from the beginning of the term, the whole DG group defined the FinTech / DX shift as the group strategy, and the mainstay Financial Technology Business set a new record high. In the Incubation Technology Business, the pandemic led to the rapid progress of digital transformation globally, which significantly increased the fair value of investees and drove profits.

Below is a summary of FY21.3 financial results.

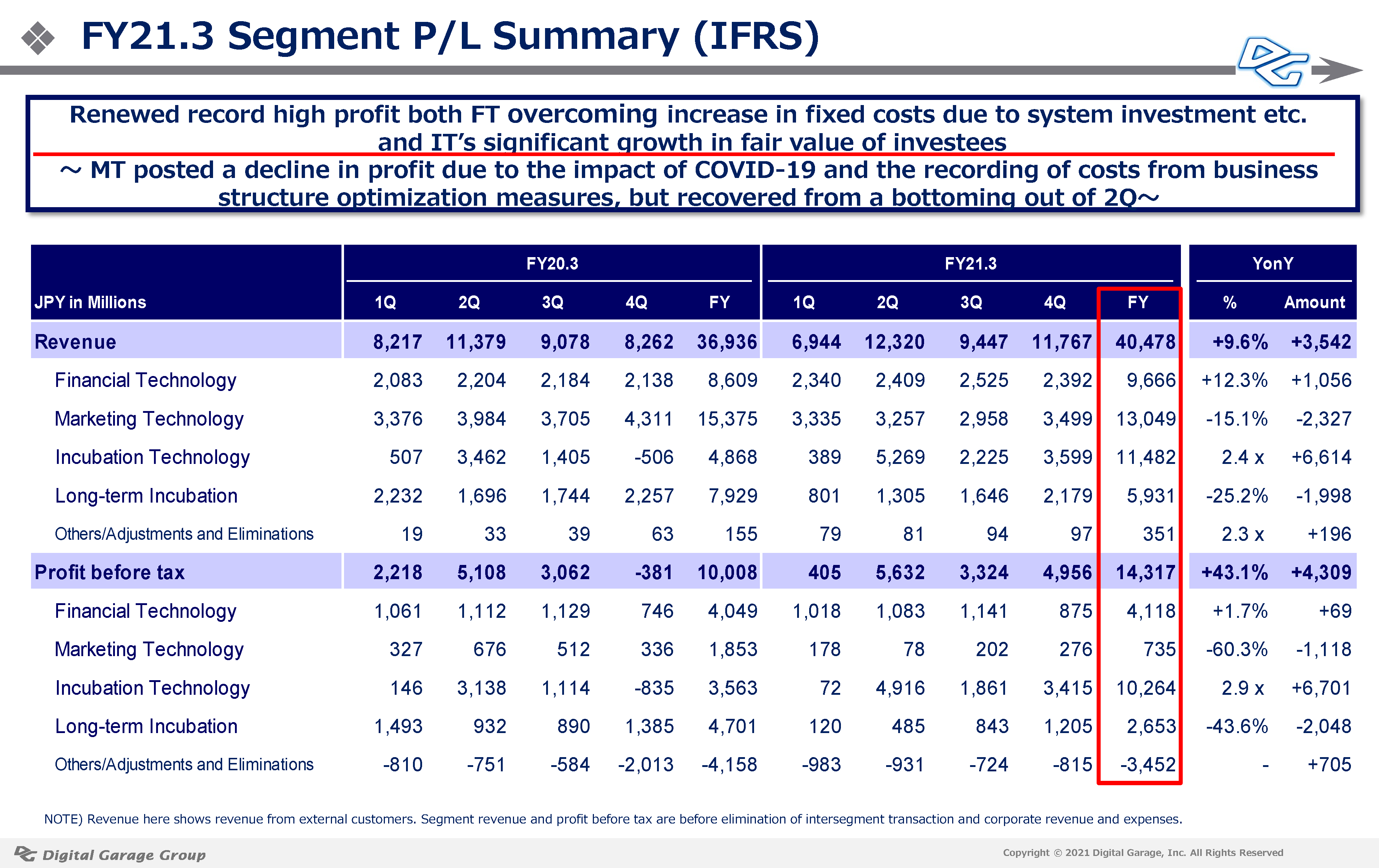

As for the consolidated business results for the fiscal year ended March 31, 2021, revenue was 40,478 million JPY (up 9.6% YoY), profit before tax was 14,317 million JPY (up 43.1% YoY), and net income attributable to owners of the parent was 9,786 million JPY (up 31.9% YoY). As a result, profit before tax, our key management indicator, reached a new record high. In the Financial Technology Business, despite the impact of the spread of the COVID-19 in travel/inbound demand, both sales and profits increased as the market size of E-Commerce expanded and domestic new payment methods were enhanced, which absorbed the increase in fixed costs. In the Marketing Technology Business, although the mainstay digital promotion business performed soundly, demand for promotions in the real estate sales, retail, and other industries plummeted. Business structure optimization costs, such as office consolidation, were also recorded. In the Incubation Technology Business, the fair value of operational investment securities expanded significantly. In the Long-Term Incubation Business, earnings declined due to restraint on consumer spending related to restaurants and entertainment, etc., as well as the suspension of business operations as a result of the spread of the COVID-19.

Below is a review of FY21.3 Segment.

FT: Financial Technology Segment

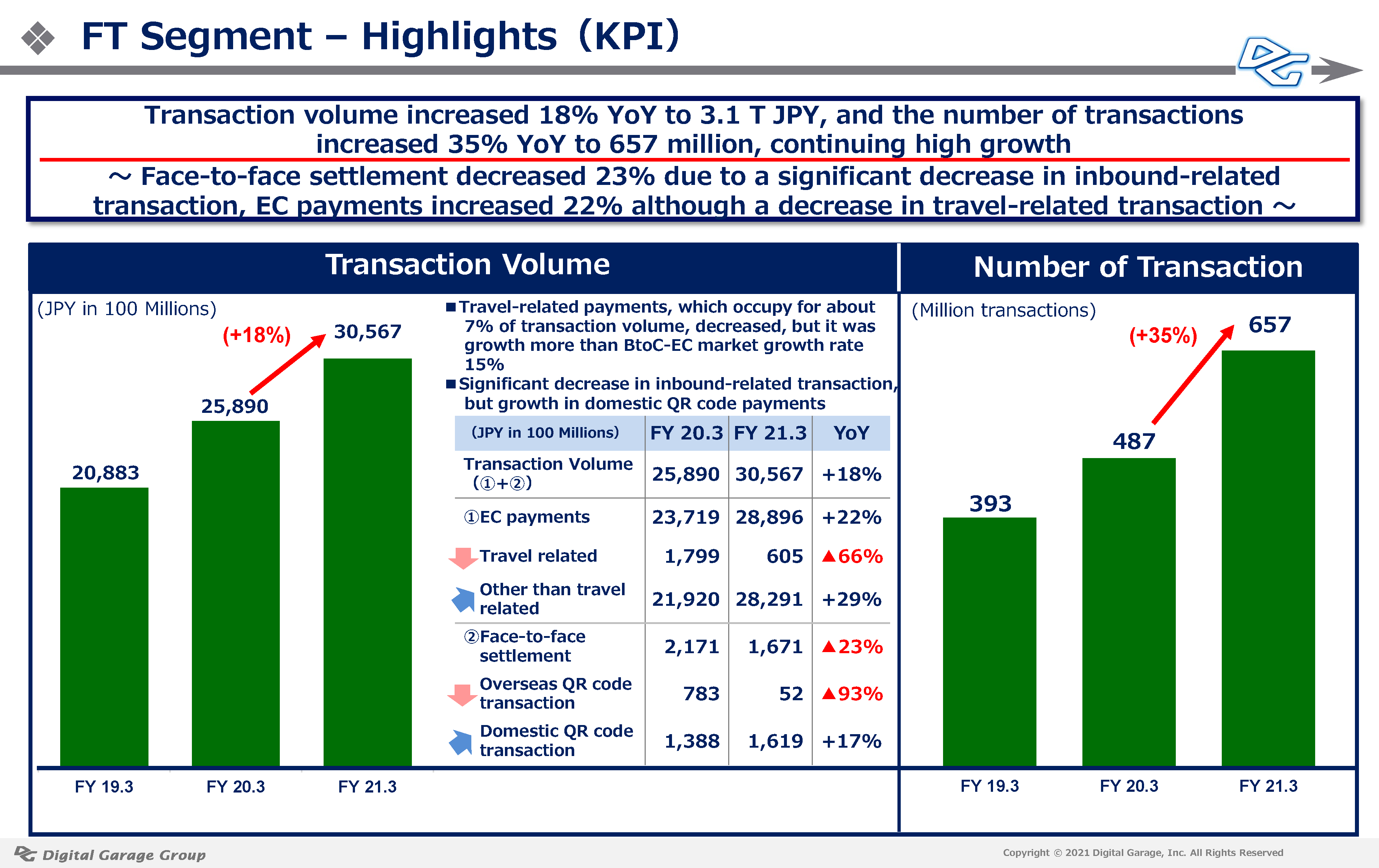

In the fiscal year ended March 31, 2021, FT segment revenue increased 12% YoY, and profit before tax increased 2% YoY to 4,118 million yen, absorbing the increase in fixed costs due to system investments, etc., to achieve a record high performance. Transaction volume, a KPI, increased 18% YoY to 3.1 trillion JPY, and the number of transactions increased 35% YoY to 657 million. Travel and inbound related transactions fell sharply by 75% YoY (approximately 190 billion JPY) . However, given last fiscal year’s travel and inbound related transactions, we see that actual transaction value could have grown by around 25%. On the other hand, the pace of E-Commerce market expansion increased, and new payment transactions, such as mobile order on-line payments and domestic QR code payments also grew.

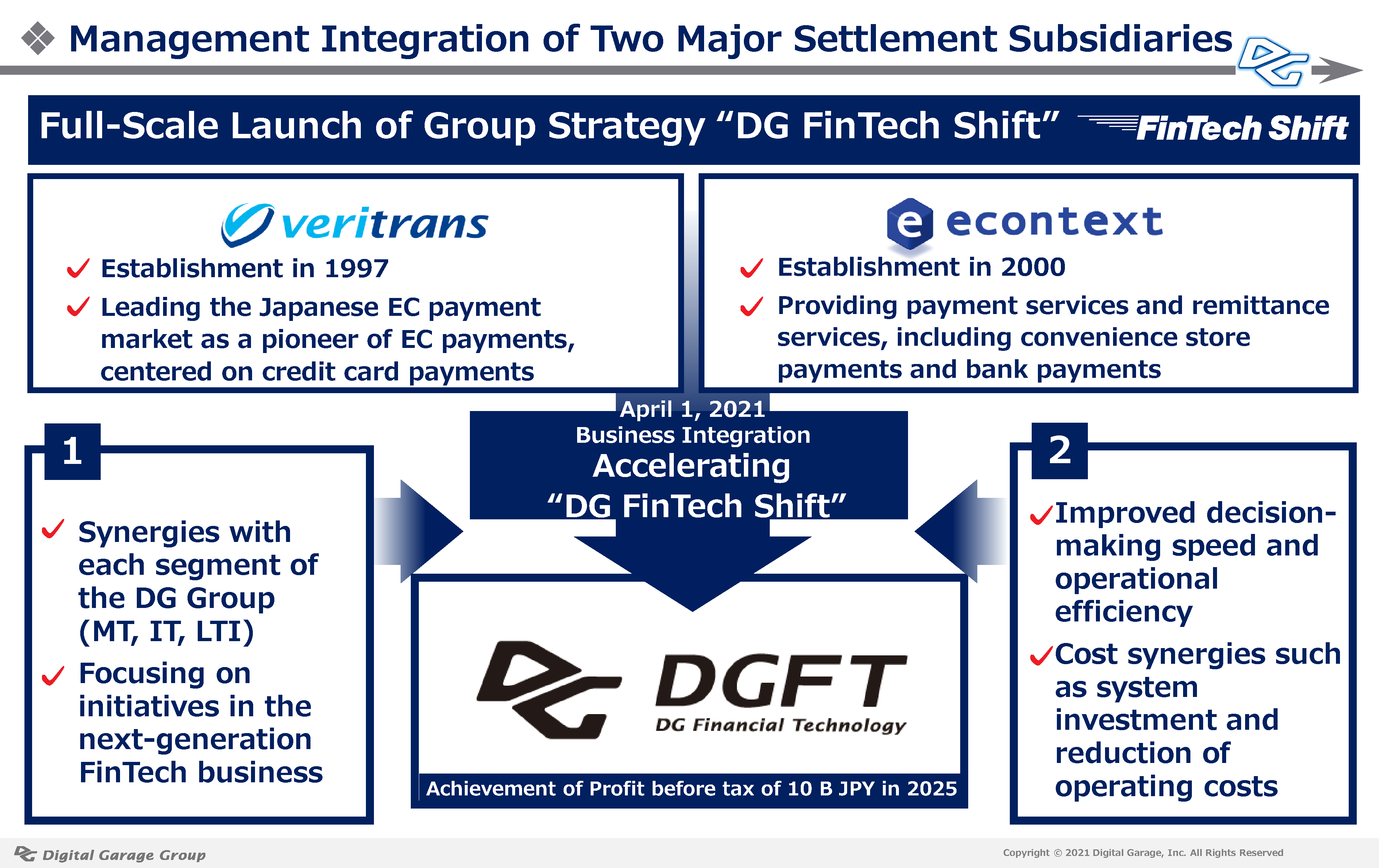

On April 1, 2021, we integrated the business of our FT segment’s core subsidiaries VeriTrans, Inc. and econtext, Inc. and changed the name of the consolidated company to DG Financial Technology, Inc.. We will promote Group strategy “DG FinTech Shift.” We will leverage our 25-year network of incubation to further accelerate payment support for businesses, and advertising, DX and CRM support for payment merchants and payment providers in marketing. Our strategy is to expand settlement transaction volume (GTV) in the FT segment and increase growth and profitability.

Please watch the video clip below that summarizes the history of DG group’s payment business and the concept of DG Financial Technology.

MT: Marketing Technology Segment

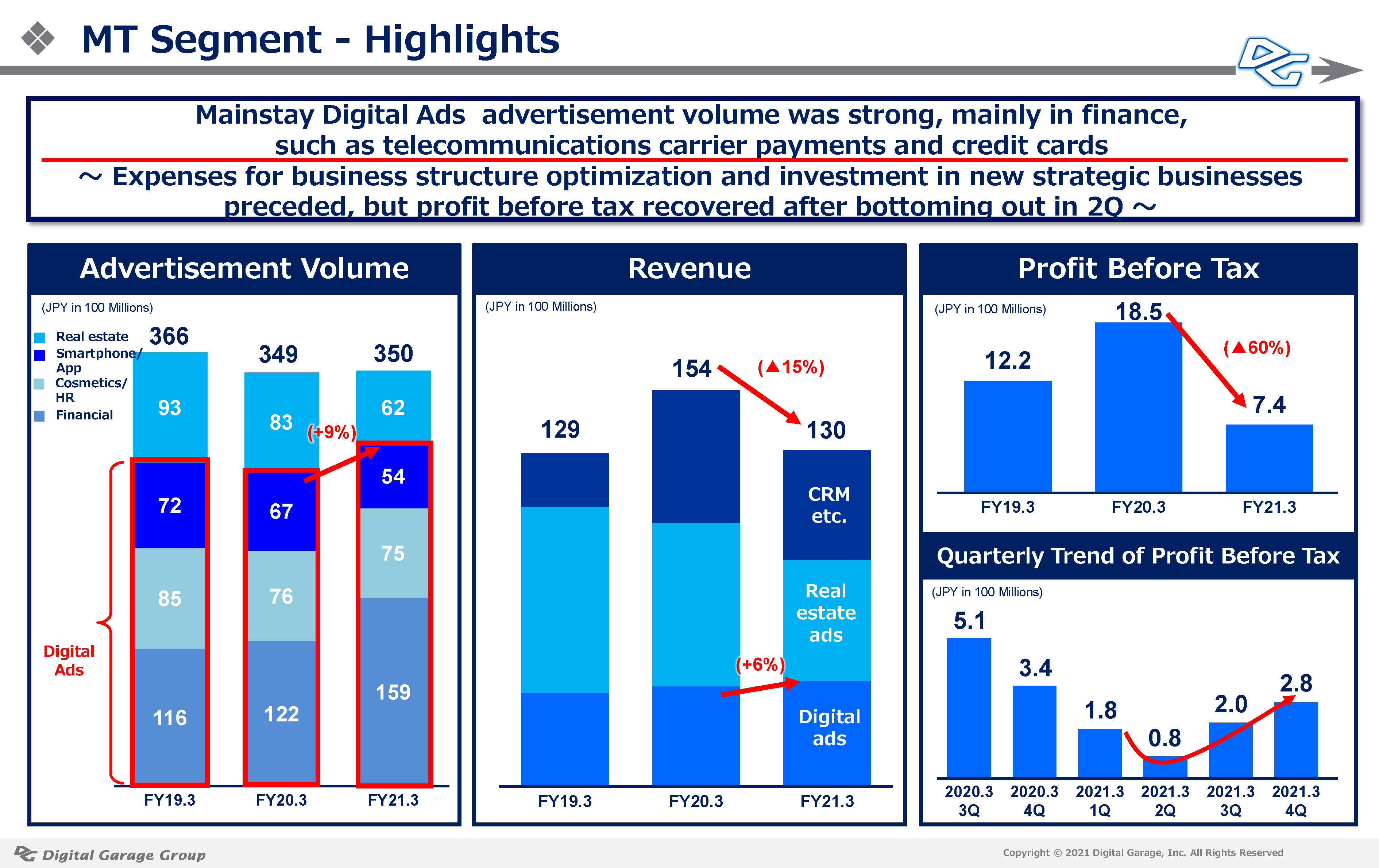

In the fiscal year ended March 2021, the MT segment recorded a 15% YoY decrease in revenues and profit before tax was 735 million JPY (down 60% YoY) . The advertisement volume in the mainstay digital ads was firm, rose 9% YoY. In particular, in cashless promotions for finance, such as telecom carrier payments and credit cards, advertisement volume was robust, up 30% YoY, realizing the FinTech Shift. On the other hand, overall advertisement volume declined due to the postponement or cancellation of promotions in the real estate and retail industries, etc. as a result of the spread of the COVID-19. In addition, costs also increased due to the promotion of business structure optimization measures such as consolidating office sites, but profitability was recovering trends, bottoming out in 2Q for the fiscal year ended 2021.3.

In the MT business, new strategic businesses are steadily growing. In particular, we will accelerate the development of the following 2 businesses as medium to long-term growth businesses.

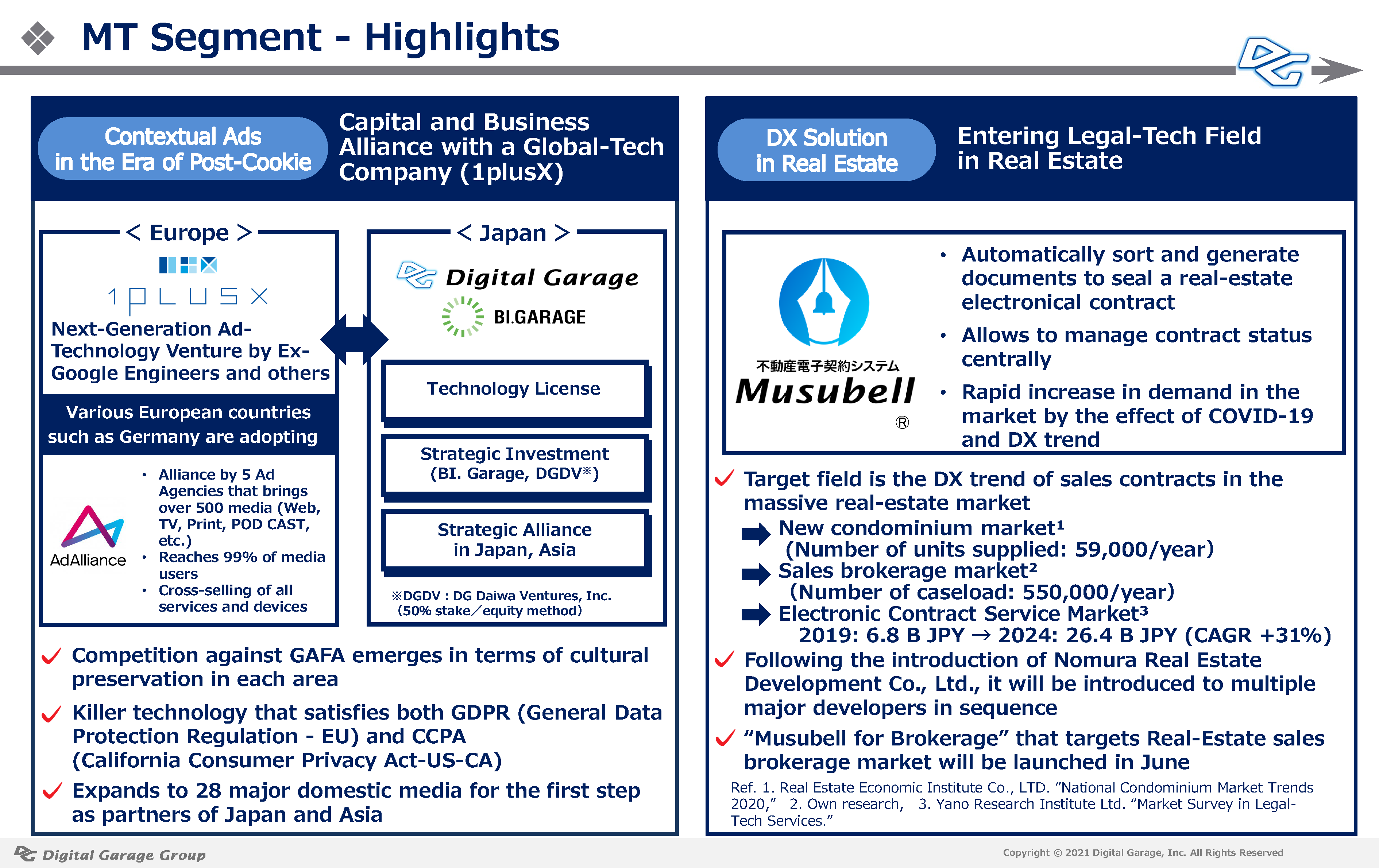

(1)BI.Garage, which plays an important role in the advertising business in the post-cookie era, has begun developing a next-generation advertising platform together with 1plusX, a leading European data platformer. By utilizing 1plusX’s platform that complies with strict privacy regulations in the U.S. and Europe, including GDPR and CCPA, “Contextual Ads” will finally be launched as a product of the Content Media Consortium, which is comprised of 28 leading media companies in Japan.

(2)“Musubell” is a centralized real estate contract management service announced in July 2020. “Musubell” reduces burdens on both the seller and the customer at the time of a new real estate sales contract, further opening up a new real estate DX field. Since the launch of the service, various companies have been introducing “Musubell,” and new services are scheduled to be launched later this spring.

IT: Incubation Technology Segment

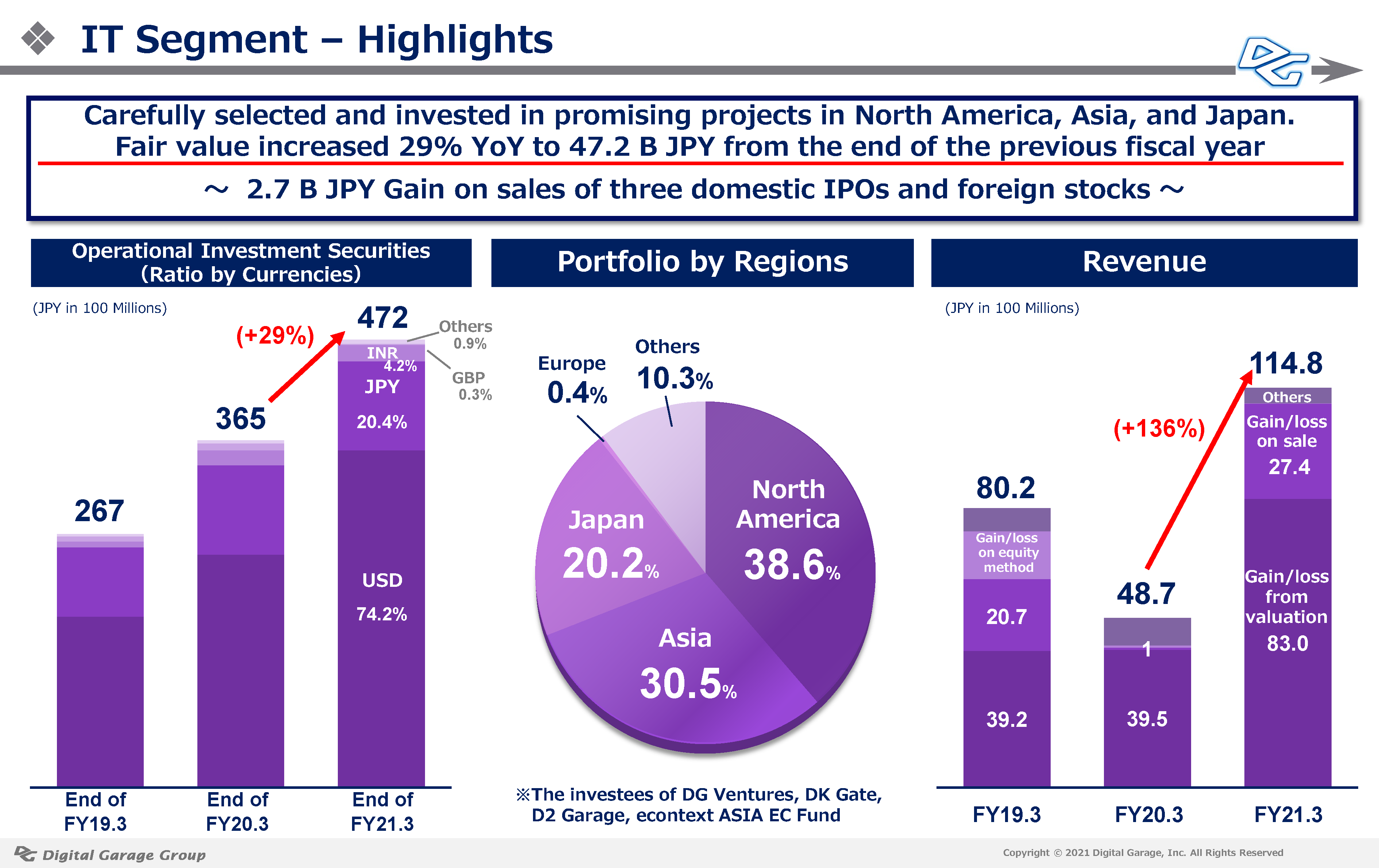

In the fiscal year ended March 2021, the IT segment recorded a 136% YoY increase in revenues and profit before tax was 10.3 billion JPY(up 188% YoY) . Revenues from operating investment securities increased 174% to 11 billion JPY as a result of an increase in fair value due to financing of investees and the sale of three stocks through IPOs in Japan and overseas listed shares, etc.. In addition, the balance sheet value, in other words value of operational investment securities, which is an important indicator for the IT segment, was 47.2 billion JPY, an increase of 10.6 billion JPY from the end of the previous fiscal year.

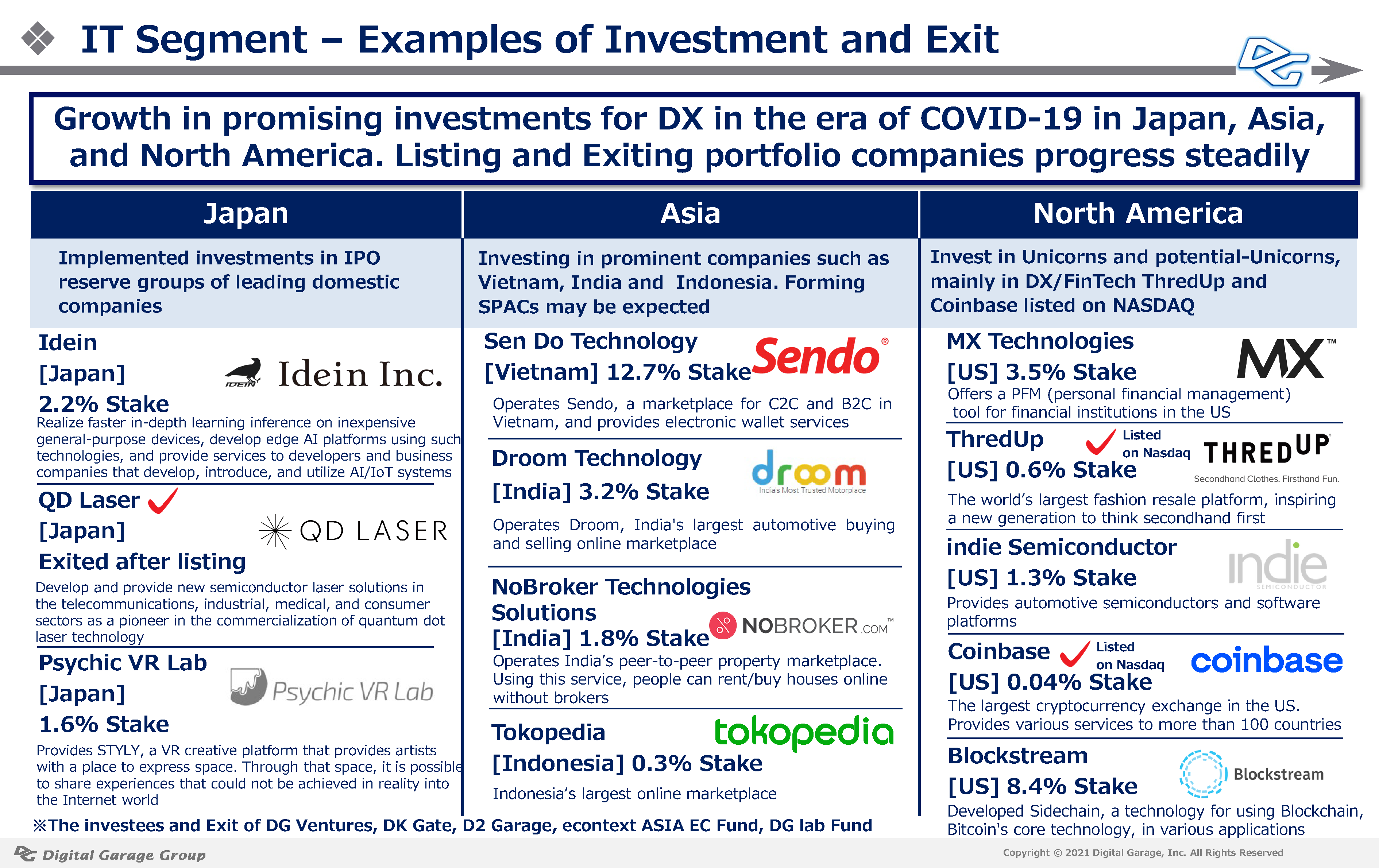

Our strategic investments in leading DX/FinTech companies have been successful, particularly in the North America area, such as ThredUp and Coinbase going public on NASDAQ. DG has been actively investing as a member of the Silicon Valley inner circle, and our portfolio companies have grown significantly while entering a period of investment recovery. In addition, our investment activities in Asia, especially in India, which we have been focusing on in recent years, are steadily bringing results. We will continue to incubate and invest in DX/FinTech/social problem solving startups in Japan, Asia and North America, and will also actively develop ESG impact investments.

LTI:Long-term Incubation Segment

In the fiscal year ended March 2021, the LTI segment recorded a 25% YoY decrease in revenues and profit before tax was 2.7 billion JPY (down 44% YoY) . Kakaku.com, Inc., which is an equity-method affiliate, continued to perform well in the shopping business of the Kakaku.com business, the Kyujin Box business and the finance business of the new media and solutions business, although profits declined due to the impact of the expansion of the COVID-19, mainly in the restaurant and travel-related businesses. Going forward, Kakaku.com, Inc. will continue to create services that are useful in a variety of lifestyle situations and provide new value.

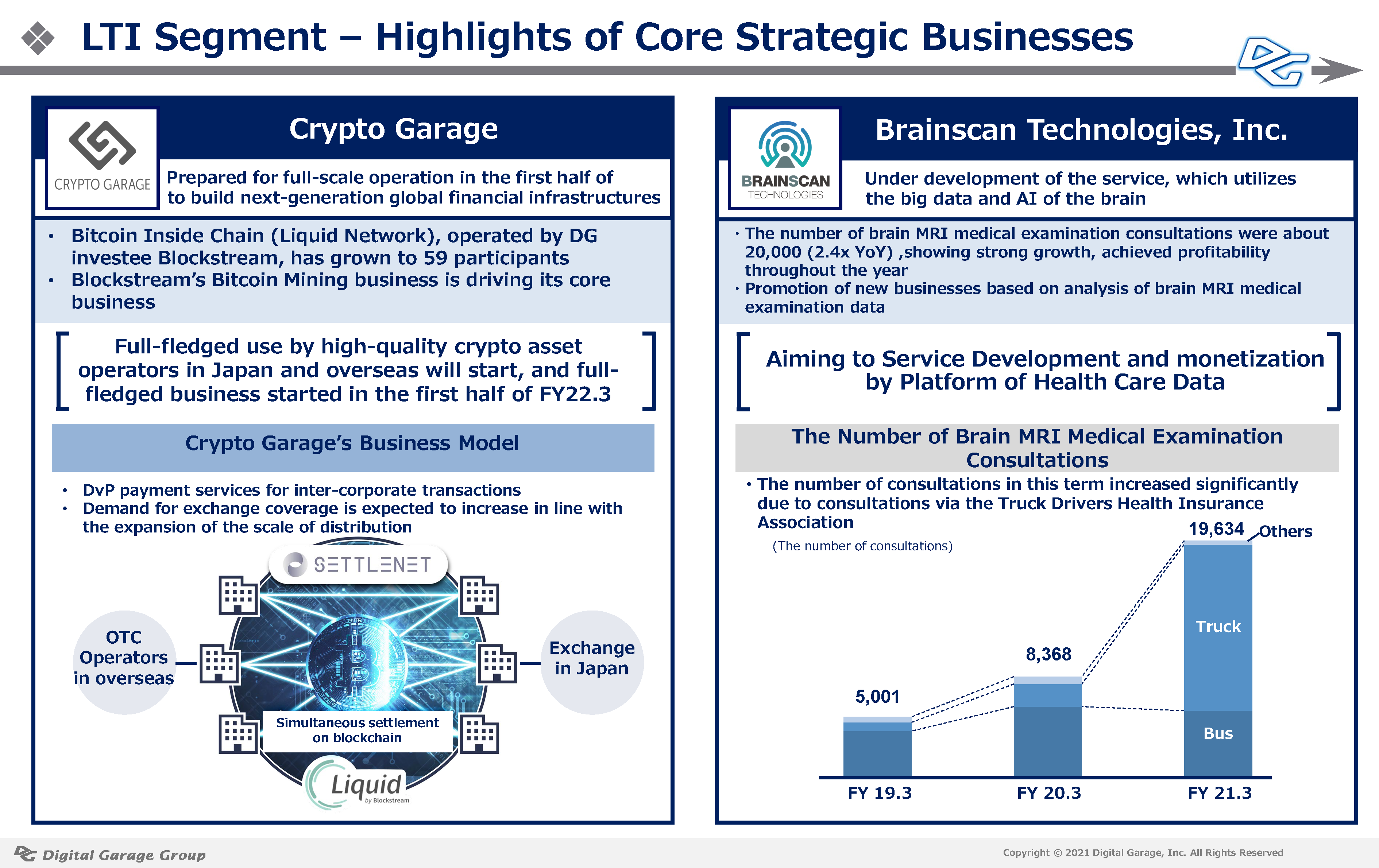

In addition, the crypto-asset business and digital health business domains that are under development are making steady progress as follows.

(1)Crypto Garage is implementing several strategic projects related to “DG FinTech Shift.” “SETTLENET,” the first project of the FinTech Sandbox of the Japanese Cabinet Office, has undergone a PoC experiment and is currently connecting with leading domestic and overseas companies to launch a DvP settlement service for corporate transactions.

(2)The number of brain MRI examinations at Brain Scan Technologies, Inc. increased by 2.4 times compared to last year to approximately 20,000, and achieved full-year profitability. We will continue to grow our business with a view to developing services in collaboration with the AI-related technologies of the DG group.

II. Official Launch of “DG FinTech Shift,” a Group Strategy to Integrate Data and Payment

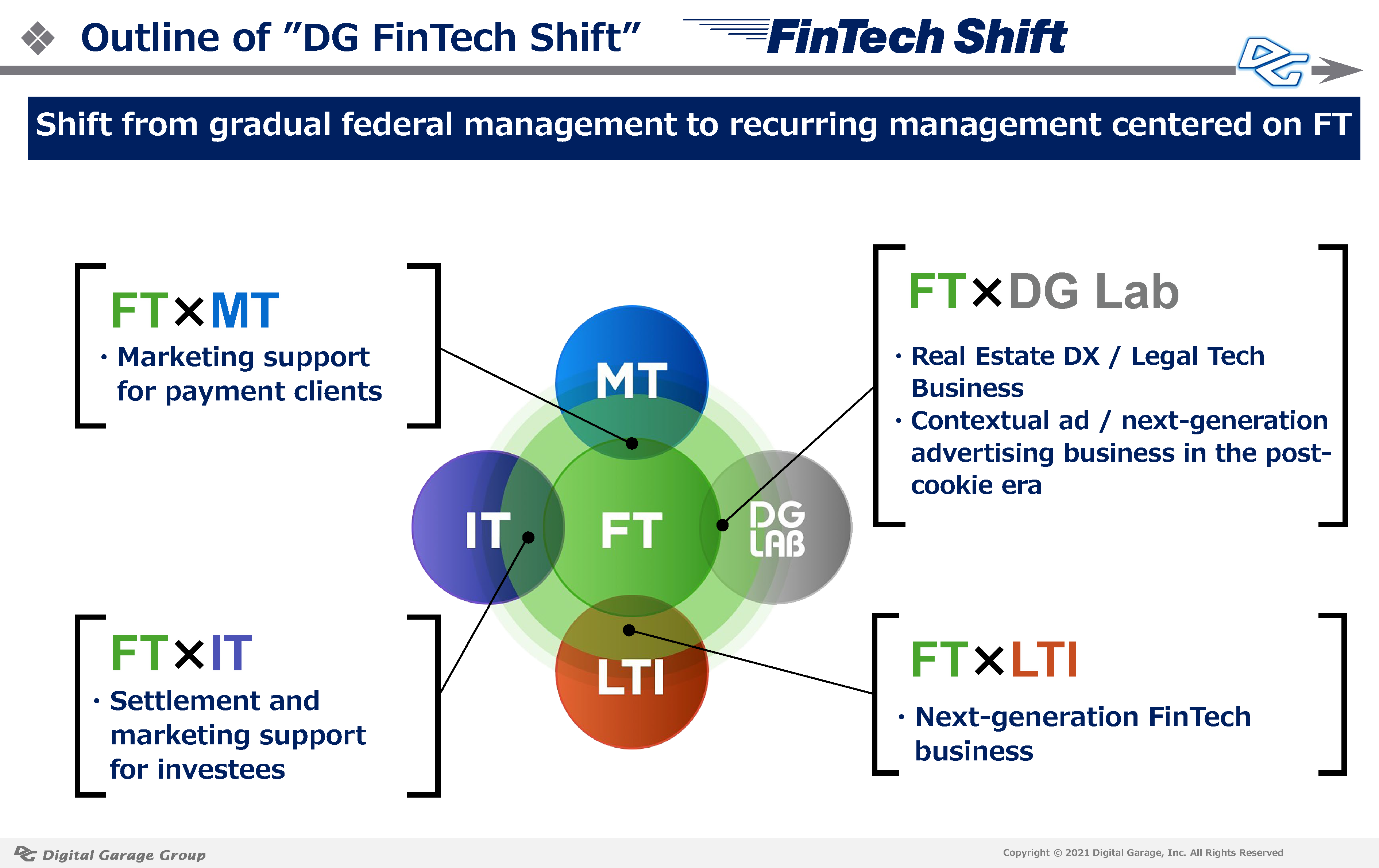

Over the past 20 years since the dawn of the Internet, our payment business has been providing a safe and secure payment infrastructure while taking on the challenge of various “Japan’s firsts,” and has grown to become a company designated as a critical infrastructure by the government, handling approximately 3 trillion yen in annual transaction volume and 600 million transactions per year. In addition to the PSP business, we have launched “DG FinTech Shift,” a group strategy that integrates payment and data, in order to develop next-generation services utilizing various technologies and data owned by the DG group.

Based on “DG FinTech Shift,” the DG group will shift from gradual federal management to recurring management centered on FT and redefine FT business as the core recurring business of the group. By combining the group’s abundant businesses and services with FT’s solid settlement infrastructure backed by stable 24/365 operations, we will enlarge a variety of payment and settlement services that support Japan as a cashless nation and evolve into next-generation businesses that utilize data. As an indispensable social infrastructure, we will contribute to develop a sustainable society.

Please watch the video clip below that summarizes the concept of “DG FinTech Shift” and corresponding projects.

III. Establishing DG’s Purpose and Mission for the Next 25 Years

We will evolve the concept of “Creating useful ‘contexts’ for the world in the Internet age,” which we have consistently used since our establishment, into a purpose that is more suitable for the ESG era.

The corporate slogan is now “New Context Designer DG.” With the corporate purpose of “Designing ‘new contexts’ for a sustainable society with technology,” we have set our sights on the next 25 years with a renewed spirit.

We look forward to the continued support and encouragement of our stakeholders, including our shareholders.